Role Player: ETF’s in a Portfolio

Exchange-traded funds, or ETFs, come in nearly every variety an investor could want.

How to invest?

The BAD Investment Company is not affiliated with these financial service firms. Their listing should not be viewed as a recommendation or endorsement. By clicking the buttons above you are leaving The BAD Investment Company website and going to a third-party site. The BAD Investment Company is not responsible for content on third-party sites.

Fundamentals |

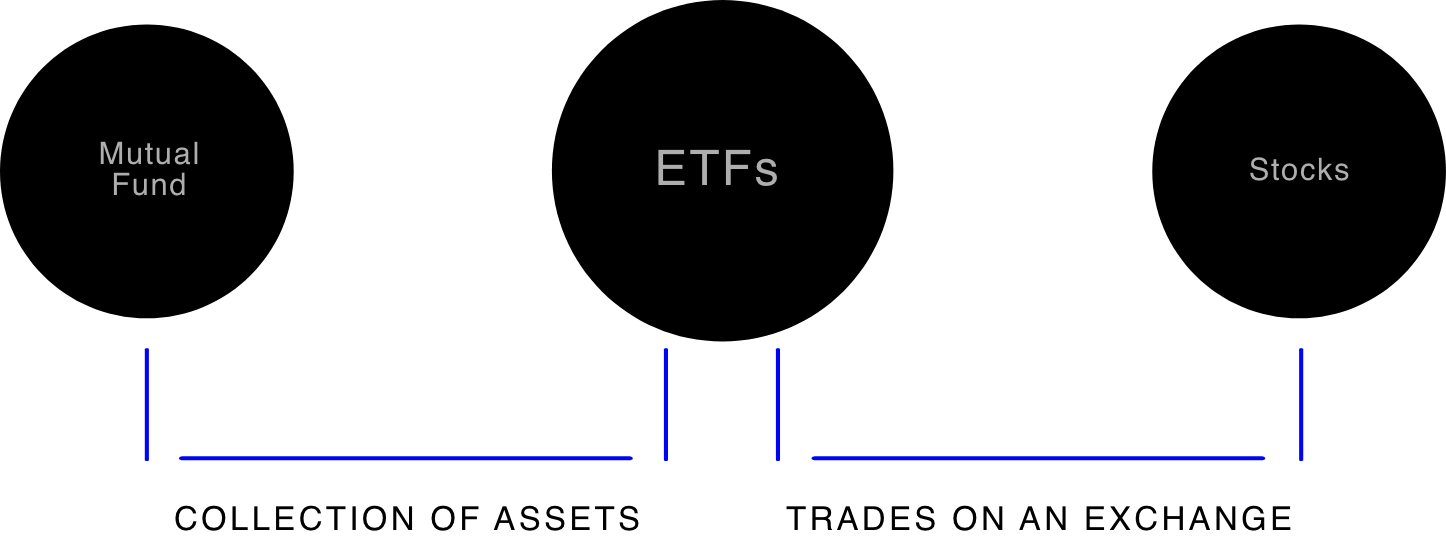

An ETF (Exchange Traded Fund) is a diversified collection of assets.

Similar to a mutual fund, a key difference is that an ETF trades on an exchange throughout the day like a stock. Being relatively low cost, tax-efficient, and generally easy to buy and sell, ETFs have become a popular choice for many investors.

Through ETFs, investors can gain access to a wide variety of asset classes and strategies—from stocks and bonds to commodities, domestic and foreign markets, individual sectors, alternative investments and sophisticated active strategies. Investors can use ETFs to support a range of their investment goals, whether ETFs form the core of a portfolio or are used to add diversification or manage potential risk.

The Rub

No minimum investment amounts and simple fee structures help keep costs relatively low.

Daily visibility into ETF holdings and share prices, allowing for more informed asset allocation decisions.

ETFs generate few taxable events due to the unique creation and redemption process, potentially lowering tax consequences.

Trade ETFs intraday and gain exposure to otherwise difficult to access opportunities.

Difference in Investment Classes

We've Got Options

Passive ETFs

ETFs that are designed to track a benchmark, or index of securities.

Active ETFs

Actively managed ETFs are like actively managed mutual funds. Portfolio managers of active ETFs determine which securities to buy and sell. Recently, the SEC approved non-transparent active ETFs. The second, an arguably more important distinction, is that of considering what type of securities a given ETF holds.

Equity ETFs

As the name suggests, these ETFs invest in stocks. Equity ETFs can vary in their mandate significantly, including selecting stocks by geography, by sector, by market cap, by fundamentals, by theme… and more.

Fixed Income ETFs

Similar to Equity ETFs, these funds can target different areas of the fixed income market, and therefore allocate to bonds instead of stocks.

Commodity ETFs

Commodity-based ETFs typically come in two forms – physically-backed or futures-based. While physically-backed commodity ETFs actually buy and hold the relevant commodity, futures-based ETFs typically own front-end futures contracts, introducing additional complexity.

Thematic ETFs

As discussed above, certain equity ETFs seek to provide exposure to themes. Typically, these themes don’t fall nicely into pre-defined sectors or geographies, but rather attempt to identify companies that are exposed to developing themes in the equity markets.

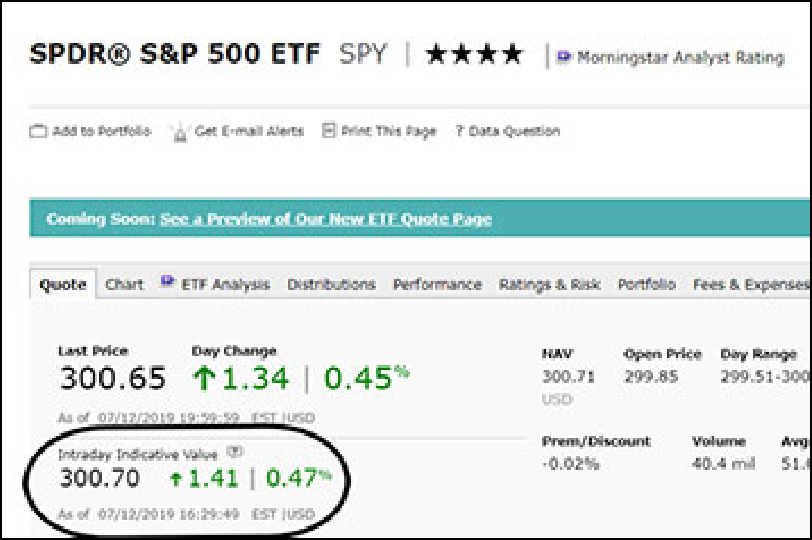

Once you’ve decided on an ETF you’d like to buy, be sure to first check the fund’s Intraday Indicative Value – another fancy term that really just means “current NAV”. This can be found on many publicly available sources, including Morningstar.

For highly traded ETFs, this exercise is less critical. For ETFs that are less frequently traded, however, it is important to compare the “current NAV” versus the bid and ask prices. If the ask price is too high, you may want to consider placing a limit order.

Virtually all U.S. brokerages offer ETF trading just as they would for individual stocks.

What We Learned

ETFs are versatile tools for investors, suitable for a wide range of investment goals. Being able to trade ETFs on exchanges like stocks gives investors flexibility to employ different trading strategies and offers a relatively quick way for investors to add diversification to their portfolio. We believe features such as daily transparency of holdings, simple fee structures, and tax efficient operations make ETFs a cost-effective and straightforward investment vehicle. As with any investment, investors should carefully evaluate an ETF to determine whether it fits well within their portfolio.

Carefully consider the investment objectives, risks, charges and expenses of The BAD Investment Company ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments may also be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Investments in foreign securities involve social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

BAD is distributed by Foreside Fund Services, LLC.