Let’s Roll

Meet BAD, your next vice.

What was BAD is now Good

- Loading stock data...

Be Bold, Be Bad

It's Time to Capitalize on Being BAD

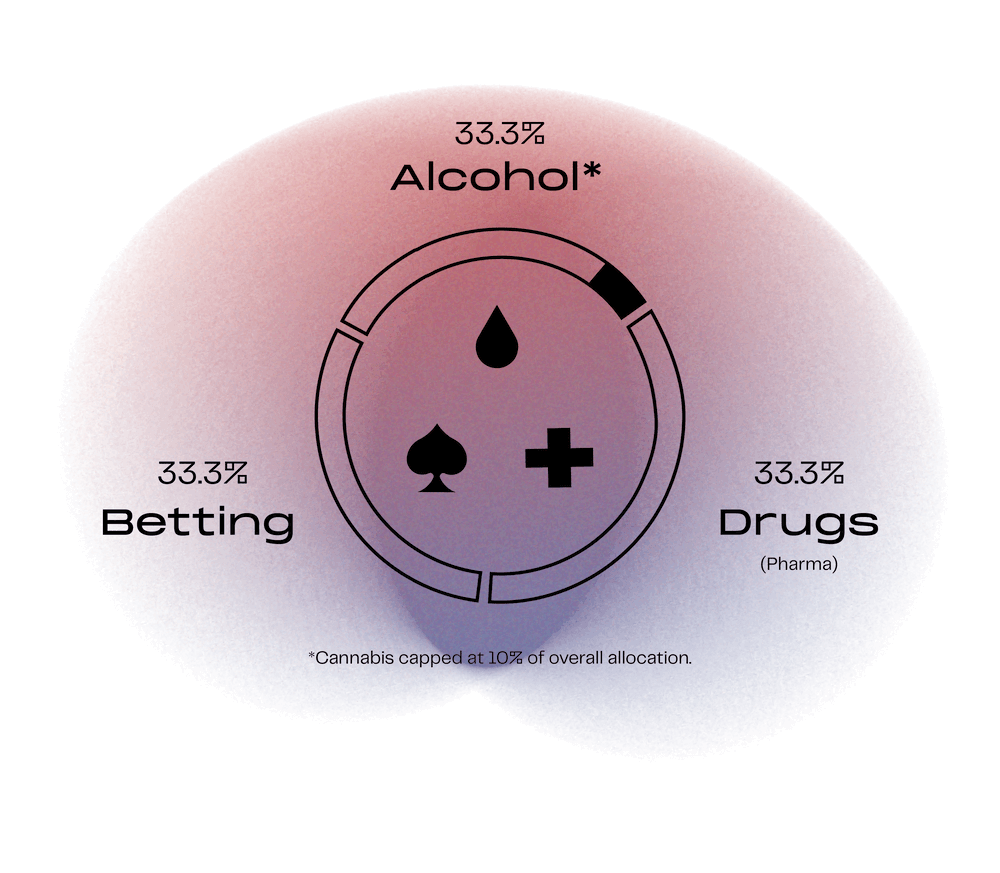

Welcome to BAD, the ETF defined by the Betting, Alcohol & Drug industries.

The B.A.D. ETF (BAD) is a large cap fund designed to track the EQM BAD Index (BADIDX), which tracks price movements of a portfolio of U.S. listed companies with exposure to the following B.A.D. market segments: Betting, Alcohol, Cannabis, and Drugs (Pharmaceuticals and Biotechnology).

Fund Overview & Pricing

Date as of Market Close on 11/28/2023

BAD

Fund Ticker

$9,528,317.07

Net Assets

800,000

Shares Outstanding

$11.91

NAV

$0.00

NAV Change Dollars

0.00%

NAV Change Percentage

$

Market Price

$

Market Price Change Dollars

%

Market Price Change Percentage

%

Premium/Discount Percentage

11/28/2023

Rate Date

%

Median 30 Day Spread Percentage

Fund Details

As of 12/31/2022

B.A.D. ETF

Fund Name

12/22/21

Fund Inception

BAD

Ticker

NYSE

Primary Exchange

54

Fund Holdings

BAD.NV

NAV Symbol

Indexed

Management Style

Quarterly

Rebalance Frequency

0.75%

Expense Ratio

53656F235

CUSIP

N/A

30-Day SEC Yield

BAD Performance Chart

Past performance is not indicative of future results. You cannot invest directly in an index. Index performance does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in the index. Index performance assumes reinvestment of dividends but does not reflect any management fees, transaction costs, brokerage commissions on transactions. Such fees, expense and commissions would reduce returns.

Date as of 09/30/2023

The cumulative data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling 833.333.9383.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Market price is the price at which shares in the ETF can be bought or sold on the exchanges during trading hours, while the net asset value (NAV) represents the value of each share’s portion of the fund’s underlying assets and cash at the end of the trading day.

BAD Top Holdings

Date as of Market Close 11/28/2023

Growth Opportunity & Changing Trends

Expansion of Legalization in Betting & Cannabis may provide growth into new markets

New pharmaceutical developments are critical to the economy

Business-to-consumer trends has increased accessibility which may benefit each B.A.D. Industry

Potential for Attractive & Controlled Return

Diversification in 3 industries may reduce single industry or sector risk*.

Industries & products are staples of society and human behavior

The B.A.D. Industries have demonstrated willingness to adapt to their consumers and grow through new developments and consumer trends

Rooted in History

Historically, B.A.D. industries have endured multiple economic cycles and demonstrated to be profitable businesses

Adapted and embraced political pressures and regulations to improve their business practices

If the past is any indicator for the future trends, consumers will continue to need medicines, consume alcohol, and gamble.

Minimal Technology Exposure

Technology & Growth stocks typically trades at higher multiples which has historically been negatively impacted in a rising interest rate environment that the Fed has recently indicated to moderate inflation.

COVID-19 Reopening

We believe the B.A.D. industries will benefit in a post-pandemic environment as consumers may seek more forms of entertainment but also rely on vaccines and therapies offered by the pharmaceutical industry.

Contra-ESG

We believe that environmental, social, and governance (ESG) funds may be overvalued and oversaturated in a space that has yet to achieve any significant cash flows or profitability. In addition there is a lack of clarity in what constitutes a company to be ESG. *ESG is an approach to evaluating the extent to which a corporation works on behalf of social goals that go beyond the role of a corporation to maximize profits on behalf of the corporation's shareholders.

Let’s Roll