Role Player: ETF’s in a Portfolio

Exchange-traded funds, or ETFs, come in nearly every variety an investor could want.

How to invest?

The BAD Investment Company is not affiliated with these financial service firms. Their listing should not be viewed as a recommendation or endorsement. By clicking the buttons above you are leaving The BAD Investment Company website and going to a third-party site. The BAD Investment Company is not responsible for content on third-party sites.

Fundamentals |

No two investors have the same journey.

Each investor’s journey is driven by personal perspectives and individual goals. But there is one thing we all have in common. We all have to start somewhere.

So let’s get to it. We break down five moves anyone can put into action to help put themselves on the right path.

One

Just like Google Maps, you want your financial road map to have a zoom-in/zoom-out feature. Start by identifying long and short-term goals. It will create clarity and serve as a guide for investment actions.

Important things to think about at this stage are expenses and cash flow.

How much you have coming in? How much you have going out? How much is left over to invest? Are debt, large upcoming purchases or a lack of savings possible roadblocks to reaching defined goals? If so, what can be done to flip the script? All roads on the financial planning journey are paved with the same material—cash. Ensure you have solid financial health and a comfortable amount of savings before you start trading.

And while you’re road mapping the plan, establish an ETA for your goals.

If I’m road-tripping across the country, I’m probably going to want to stop and look at a couple things along the way. The same goes for your financial investment road trip. Identify milestones throughout your investment journey (and you’ll celebrate them). Doing this will keep you engaged in navigating the process and help keep you on track with your timeline.

TWO

You don’t need a PhD in finance or economics to get started investing. Having a basic understanding and being aware of the different investment vehicles at your disposal can be beneficial though.

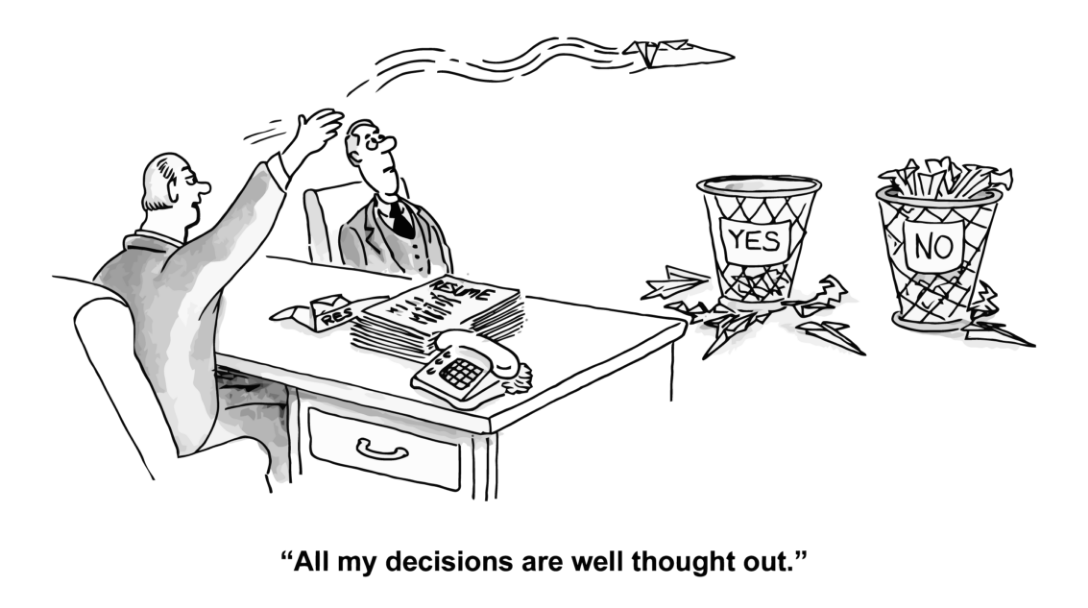

Otherwise we’re just playing Russian roulette with our money, aren’t we?

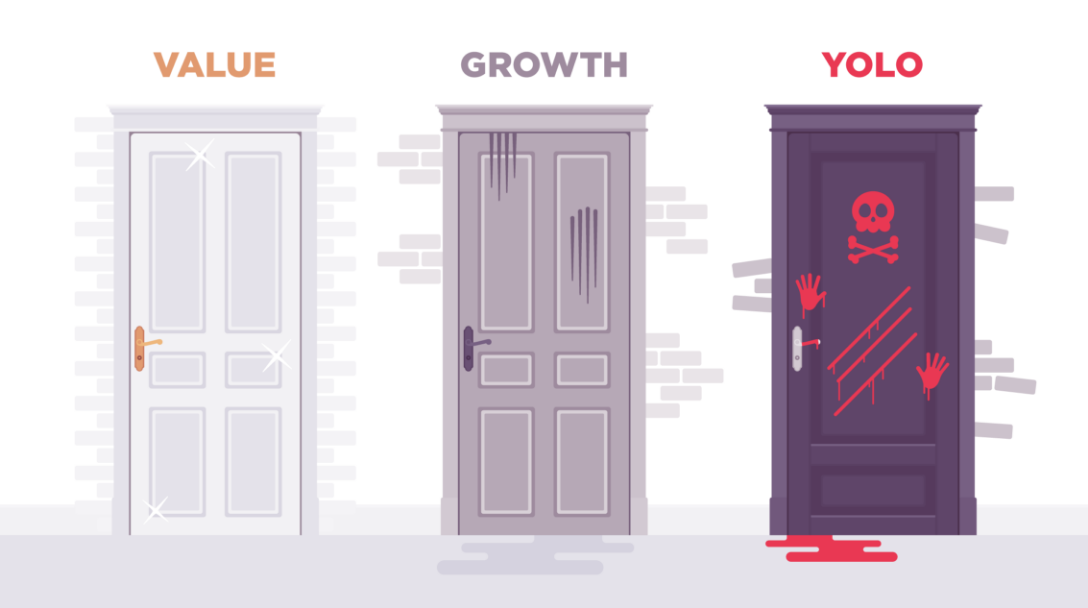

And while all people were created equal, not all investment options are.

Critical at this stage is to make sure the investment vehicles you choose align with your goals. For example, if you are at the beginning of your investment journey and looking to slowly acclimate, you may want to begin with an investment vehicle that, categorically, tends to carry a lower risk profile such as a mutual fund or ETF, as opposed to an individual stock.

Part of this learning process is knowing how to evaluate your options. If I’m buying a house, I need to know how to evaluate the features. Are the appliances new? Is the foundation solid? Is there a basketball hoop in the driveway?

The same approach goes for investment vehicles. Total return, expense ratio and performance can be important factors that have the potential to effect your investment positively or negatively. Find reliable sources of information that can teach you the basics of evaluating investment vehicles. Consume them daily. Practice. Eat your Wheaties. Drink your milk. Go forth and prosper.

THREE

Plowing your cash into one type of investment or market segment can inherently elevate your risk profile.

The market is no different than midwest weather. It may be 70 and sunny one day, and 35 and sleeting the next. And that’s why people in the midwest have both shorts and parkas at the ready. As investors, wear what you want. But make sure you select the investment vehicles that will help build a closet full of options so you can do what you need to do in any weather.

In short, we diversify to create balance. When one asset class is tanking, investments in differing asset classes have the opportunity to buffer the potential loss. Hedge your bets. Suffer less (usually).

FOUR

Just as each person’s investment journey is unique to their goals, the level of risk each investor is comfortable with taking is unique to their personal preferences and mental fortitude.

After you have educated yourself on different asset classes and investment vehicles, it’s important to categorize the different investment approaches:

* Bucket 1 = Investment vehicles you feel are “more risky”

* Bucket 2 = Investment vehicles you feel are “less risky”

For example, individual company stocks are typically put into the “more risky” category, while Treasury Bills are commonly thought of as “less risky” due to the fact that they’re backed by the government (companies often fail – governments less so, typically speaking).

The other risk tolerance component is longevity. Which ties back to your financial road map.

What are your short-term and long-term goals and how long do you anticipate it will take you to reach them? Is your plan to keep your money invested for the next 3-5 years, or the next 20-30 years? Time horizon is an important distinction to make when determining your risk threshold. It helps to calculate for potential volatility and an appropriate amount of time for investments to rebound from potential downturns.

FIVE

Well, we’ve established our goals, learned the ropes, and identified how much risk we’re willing to take … let’s light this candle.

If you are not already familiar, opening a brokerage account will give you access to a web platform where you can conduct research on potential investment options, place your trades and eventually, track the progress and performance of your portfolio.

There are several different brokerages to choose from. All of which have made the process relatively easy, more or less like opening a bank account. Do your research and select the option you think is best suited to meet your personal investment preferences and needs.

Once your account has been set up, the last step is depositing money to your brokerage account (you know, so you can make trades) by transferring funds from an existing bank account.

Each brokerage has a customer service team to answer any questions or concerns you may have about the logistics of your account.

What We Learned

Investing does not have to be complicated. You do not need to be an expert in order to start. What you do need is to have a purpose (see the ball, be the ball, make the ball go in the hole). Define what you seek to achieve by investing and the anticipated time horizon to get there. Self-education is key and not all information is created equal. Nor are investment vehicles. Calibrate your investment strategy for your risk tolerance. Don’t get crazy. Work the plan. Trust the process. (And don’t #yolo on #crypto)

Carefully consider the investment objectives, risks, charges and expenses of The BAD Investment Company ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments may also be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Investments in foreign securities involve social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

BAD is distributed by Foreside Fund Services, LLC.