Role Player: ETF’s in a Portfolio

Exchange-traded funds, or ETFs, come in nearly every variety an investor could want.

How to invest?

The BAD Investment Company is not affiliated with these financial service firms. Their listing should not be viewed as a recommendation or endorsement. By clicking the buttons above you are leaving The BAD Investment Company website and going to a third-party site. The BAD Investment Company is not responsible for content on third-party sites.

Fundamentals |

See the market. Be the market. Make the market work for you.

From the trading greats to the newest newbies, we all have one thing in common. We all have to start somewhere. And it begins by learning the getting the hang of the fundamental elements of trading.

This brief intro to stock trading will give you a starting point and walk you through some of the basics so you can feel confident getting started on your trading journey.

If you are brand new the world of trading, you may want to start with exchange-traded funds (ETFs) instead of stocks. ETFs allow investors to buy a bundle of stocks that are packaged into one basket, rather than purchasing a single stock on its own. This can help investors add a degree of diversification to their investments and limit volatility extremes of any one stock.

If you do decide to trade individual stocks, know that it is a difficult task. There are myriad factors that go into analyzing potential targets. To start, investors can use financial analysis ratios to compare a company’s performance to its competitors. Doing so can help determine if a stock is under or overvalued.

A number of other assessment mechanisms are available and used by traders of all types. To figure out what assessment tools you might focus on using, start by determining your trading style and strategy. Then, determine which assessment tools are more ideal than others to grade the attractiveness of stocks on your target list based on your style of trading.

PLACE YOUR BETS

A market order is all about immediacy. This type of order allows you to buy or sell shares at the next available price. If the market order is to buy shares, the order will get filled at the next available “ask” or selling price.

If the market order is to sell shares, it is likely to get filled at the next available “bid” or buying price. Market orders are generally used when there is a need to get in or out of a position as quickly as possible.

To be clear, market orders may be fast and efficient, but that doesn’t mean the fill price will be ideal—and it may not be the same price you see on your screen when you click “send” to place the order.

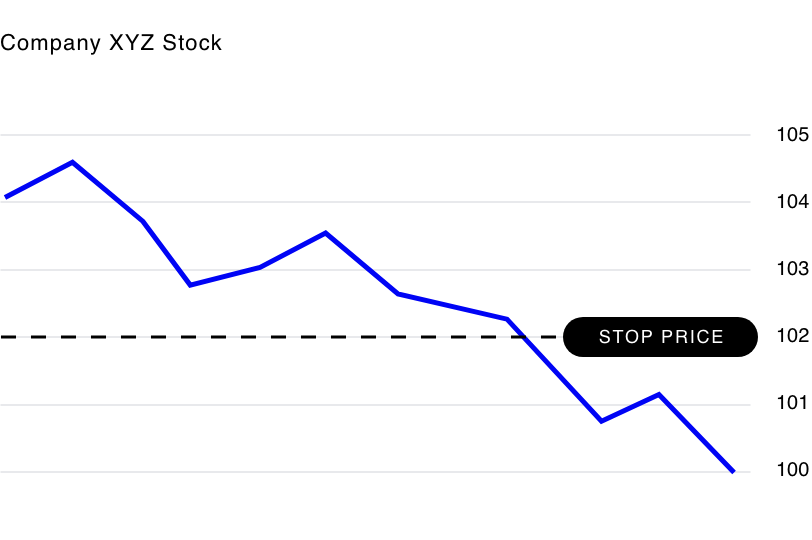

A stop order (also referred to as a “stop-loss” order) allows you to enter or exit a position once it reaches a specific price level. When the activation price is reached, the stop order turns into a market order, automatically filling at the next available ask price (in the case of a buy stop order) or best bid price (in the case of a sell stop order).

If you’re looking to buy a stock at a price that’s above the current market price, you’d place a buy-stop order. Conversely, a sell-stop order is used to limit downside risk. If you bought shares of stock and are holding an open position, you can place a sell stop below the market price to exit your position to prevent or limit losses.

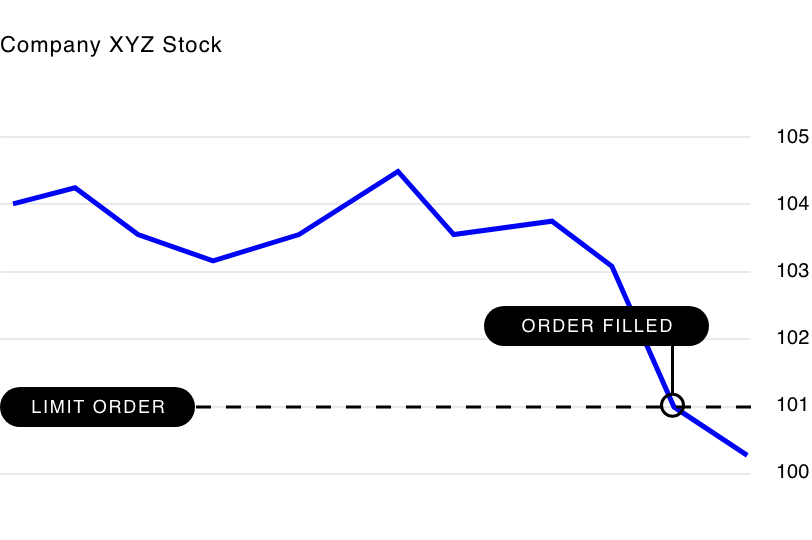

By placing a limit order, a trader essentially says, “I want to buy or sell a stock at a specific price or better.”

If you want to buy shares below the prevailing price, you will likely want to use a limit order. This means your order may get triggered if the stock trades at or below your target price. If all works out according to plan, you may get filled at or below the price you requested.

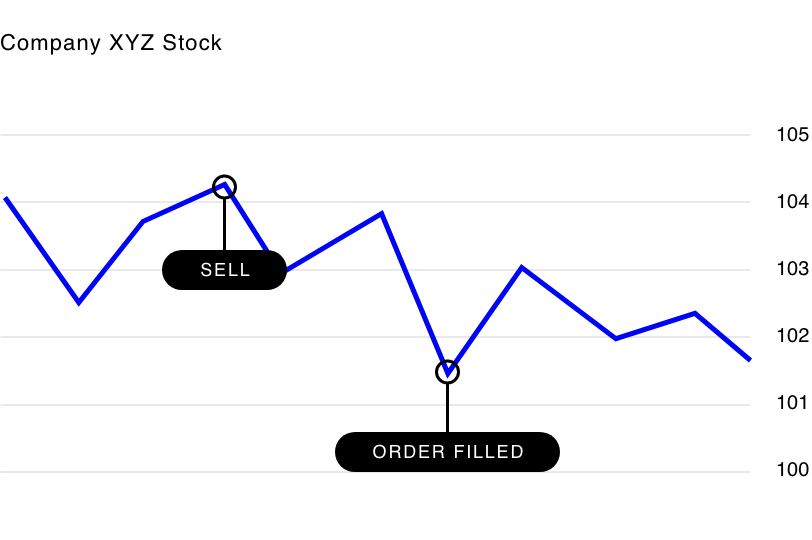

If you bought shares of stock and are looking to sell at a higher price, you might consider placing a sell limit. This is your classic “take profit” order. This order seeks to sell a stock at your price target or better, meaning higher.

THE TAX MAN COMETH

Profits you stack up from trading are also known as “capital gains.” And the taxes you pay on those profits are known as “capital gains taxes.” In general, an individual will be required to pay more capital gains taxes if they have held a stock for less than a year before selling (short-term gains) than if they had held a stock for more than a year before selling (long-term gains). This tax structure is designed to encourage long-term investing.

While selling stocks for a profit will increase your tax bill, selling stocks for a loss will do just the opposite. To prevent people from taking advantage of this tax benefit, the IRS has a regulation called the “wash-sale rule.” A wash sale occurs when an investor sells or trades a security at a loss, and within 30 days before or after, buys another one that is substantially similar. The wash-sale rule then prevents the investor from deducting a capital loss on the sale against any capital gains they might have accrued.

What We Learned

Do Your Due Diligence Selecting individual stocks is hard—new traders may want to consider starting out by trading ETFs for purposes of diversification and risk protection. Research is essential to have any chance at being a successful trader. Learn what financial analysis ratios mean to better understand a company’s performance.

Know Your Order Types Limit orders can be used to help ensure price execution. With a market order you lose price control in exchange for speed of order execution. Stop orders can be used to help protect gains or prevent losses.

Steer Clear of the Chaos Try to avoid the first 30 minutes of the trading day when stocks and ETFs are less liquid and spreads are wider. Use caution when trading on days characterized by significant volatility. Understand your personal risk tolerance and financial situation before trading.

Death and Taxes Short-term capital gains are taxed at a higher rate than long-term capital gains. The wash-sale rule prevents you from deducting a capital loss on the sale against any capital gains you might have accrued.

Carefully consider the investment objectives, risks, charges and expenses of The BAD Investment Company ETFs before investing. This and other information about each fund is contained in the Prospectus. Please read the prospectus carefully before investing as it explains the risks associated with investing in the ETFs.

These include risks related to investments in small and mid-capitalization companies, which may be more volatile and less liquid due to limited resources or product lines and more sensitive to economic factors. Fund investments may also be concentrated in an industry or group of industries, and the value of Fund shares may rise and fall more than more diversified funds. Investments in foreign securities involve social and political instability, market illiquidity, exchange-rate fluctuation, high volatility and limited regulation risks. Emerging markets involve different and greater risks, as they are smaller, less liquid and more volatile than more developed countries. Depositary Receipts involve risks similar to those associated with investments in foreign securities, but may not provide a return that corresponds precisely with that of the underlying shares. All investing involves risk, including possible loss of principal. Please see the prospectus for specific risks related to each fund.

BAD is distributed by Foreside Fund Services, LLC.